How to trade?

As with stocks, bonds can be acquired to hold until maturity, meaning the time when it expires and the debtor must repay the amount loaned plus interest, or traded in short-term due to the fact that bonds prices are volatile and have fluctuations just like stocks. The way to purchase is the same with stocks, it has evolved over the decades, firstly over the counter in a bank or broker, then over the telephone and nowadays through the internet.

Bonds can be directly acquired and held on a custodian account, as the bank or broker of your choosing, which will receive the periodic interest and the final repayment; but you can also hold bonds through an investment fund or an ETF, which may or may not distribute the interest they receive, fully or parcially. As bonds are usually bought for the longer term, investors need to be aware that there may be fees on custodian holding.

The main platforms for stock investing are banks, specialized brokers and discount brokers. Banks are the traditional broker and continue to be relied by many investors as a safe way to invest in stocks, bonds and other instruments. Specialized brokers usually only do services of brokerage and advisory, they don’t hold the deposits of the investors or the stocks, they subcontract banks and other financial institutions for those means. Discount brokers offer very low comissions to their clients as they only do services of brokerage and usually are only available online so their costs will be lower. But as governments and local authorities can issue debt, as bills or bonds, there is the possibility to acquire these directly through the administrations’ online platforms.

And, how to analyse?

Overall, the bond market has returned positive annualized gains, despite the volatility in the interest rates. Through time, it has consistently made part of every investor’s portfolio in order to diversify their risk and wealth, and will continue to be in the foreseable future.

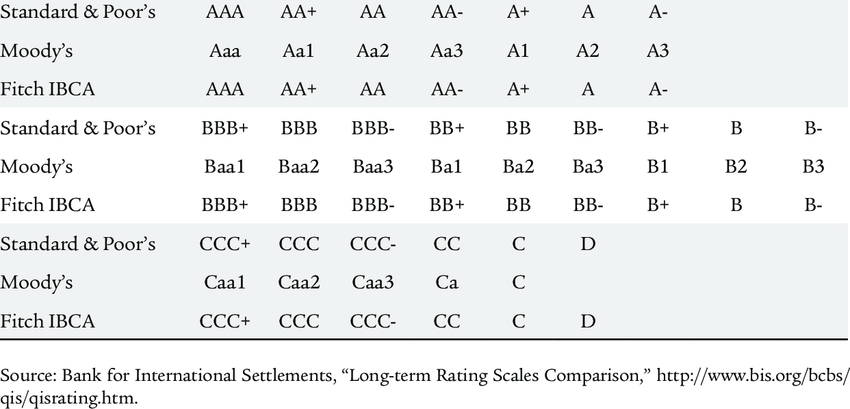

The main indicators to analyse when choosing between bonds is, of course, the credibility of any company or government, but this is measured not only by one’s perception but also by the scores given by rating companies, who analyse the issuers’ financials and the market they are inserted in order to assimiliate that market’s credit risk. It is also important to notice that the interest rates are present in their nominal value, and it is necessary to annualize the rate in order to calculate the interest received. The higher the credit score (AAA, AA+, AA, etc.), the lower the interest rate may be as the issuer knows it is credible and investors will prefer their bonds, so in a perspective of offer and demand, they won’t offer higher rates.

The returns from the stock market take two forms: interest and capital gains (realized or not). Interest is the payment of income at a fixed interest rate, periodically, to the owners of the debt, the bondholders; this interest rate can vary from entity to entity and represents the risk of investing, in which higher rates usually mean that the debtor is more risky. Capital gains refers to the variations in market price of the bonds held, be it realized when the bond is sold or unrealized when it’s the difference between the current price and the acquisition price. This way, a bond can provide both fixed and periodic cash-flow through the interest and appreciation through the capital gains.

In conclusion

Bonds are usually seen as a risk balancer in every investors’ portfolio, due to the fact that these have lower volatility that stocks, that can be explained by the fact that the income is already fixed as an interest rate, and in only few cases does the bond lose its value. The main indicators of credibility should be noticed before any purchase, such as the market risks.

Subscribe our media posts, follow our social media accounts and learn even more by clicking in the following icons.