Firstly, what are commodities?

Commodities are real assets as oil or natural gas or assets that can be used as medium of trade such as currencies, cryptocurrencies, gold, silver and other precious metals, which can hold value in themselves and be transactioned on a market. Some are physical like natural resources and some can be virtual as digital currency or cryptocurrency.

Usually, commodities are transactioned in terms of futures, a financial instrument which the price represents the expected future price of an underlying asset, so the real asset is not transactioned. This is most common with the transaction of natural resources like natural gas, oil, timber but also precious metals, although the purchase of hard/real precious metals is also popular, in forms like bars, coins but also jewelry.

The main market players in terms of natural resources are the businesses who need those resources to operate, just like oil to oil companies for refining, timber to wood or furniture companies or natural gas to electricity companies. On the other side, the main market players from precious metals are central banks, hedge funds and other financial institutions that use these commodities to hold as reserve of value against currencies or other assets.

So, what’s the perfomance?

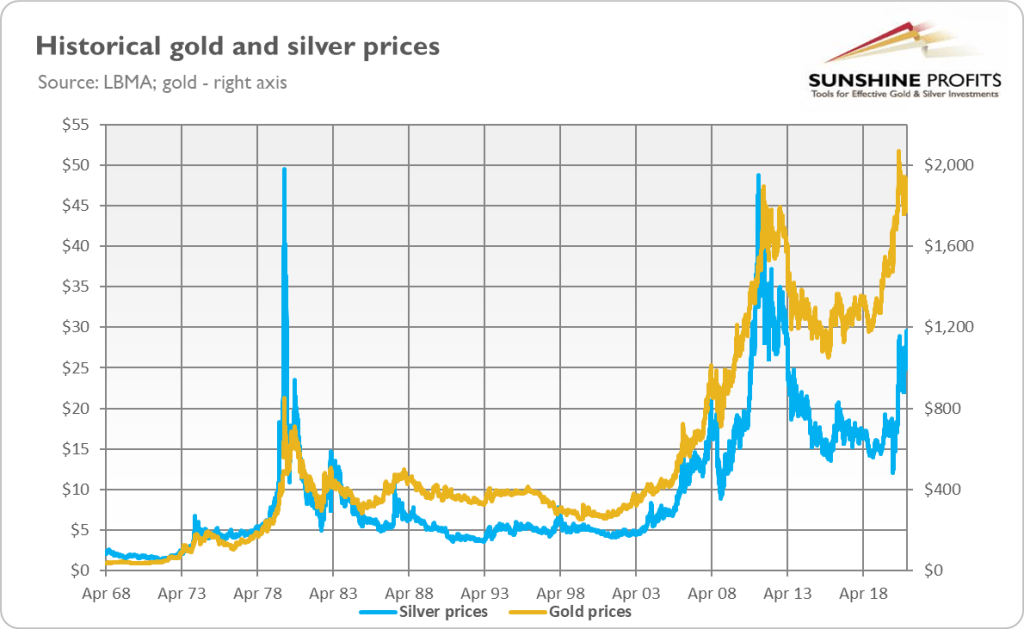

Both gold and silver have a upward tendency, but are also very affected by other assets market swings, e.g. stocks and bonds, as we can see in the graphic below which shows the price of an ounce of gold and silver from 1968 to 2020. Both metals suffered a surge on the end of the 1970s and beginning of the 1980s, due to the Bretton Woods agreements which saw the de-pegging of these value havens from the US Dollar and other currencies, and the same happened after the financial and economical global crisis from 2008 onwards and the covid-19 epidemic in 2020. Aside from these specific events, gold and silver maintain a stable price fluctuation and that contributes even more to the perception as a safe haven against inflation and economic or financial crisis.

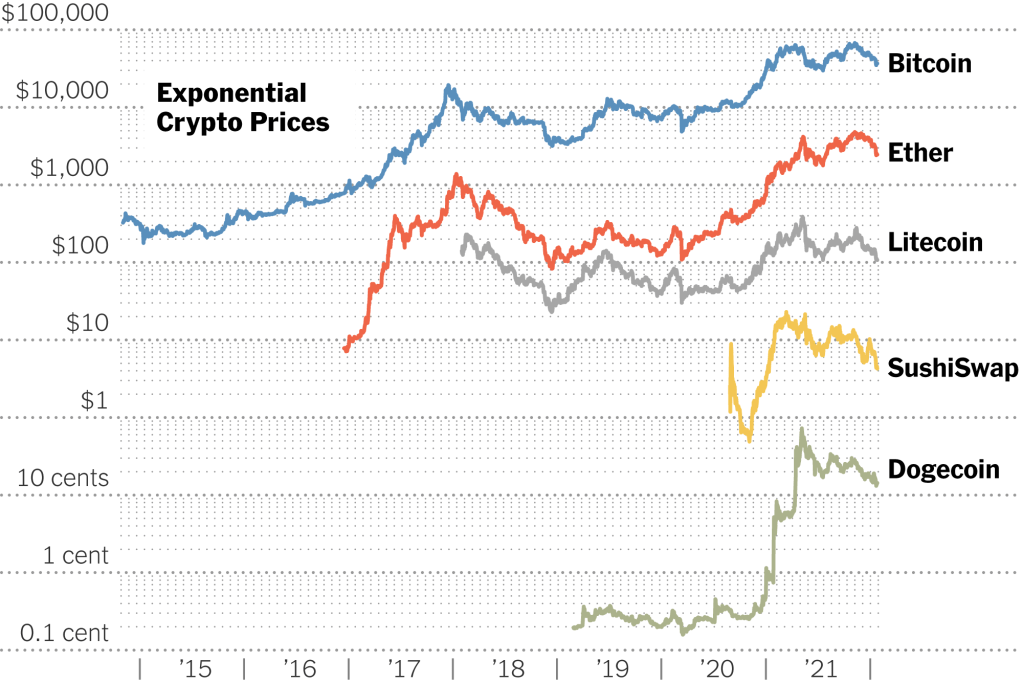

Cryptocurrencies have seen a large surge since their popularization as an alternative safe haven for some or mere speculation instrument for other, and the opinions remain divided. Either way, there’s much to gain from holding or trading cryptocurrencies as they solidify their positions. The major cryptocurrencies, Bitcoin and Ethereum, are widely used as currency for online transactions but also for holding value on long-term, being the ones with most volume traded and biggest capitalizations: market value of the total currency available. Other cryptocurrencies have their positions well defined too, and other are just seen as speculative assets that can “explode” or burst; it’s up to the investor to define the perspective and decide to hold or just trade the asset.

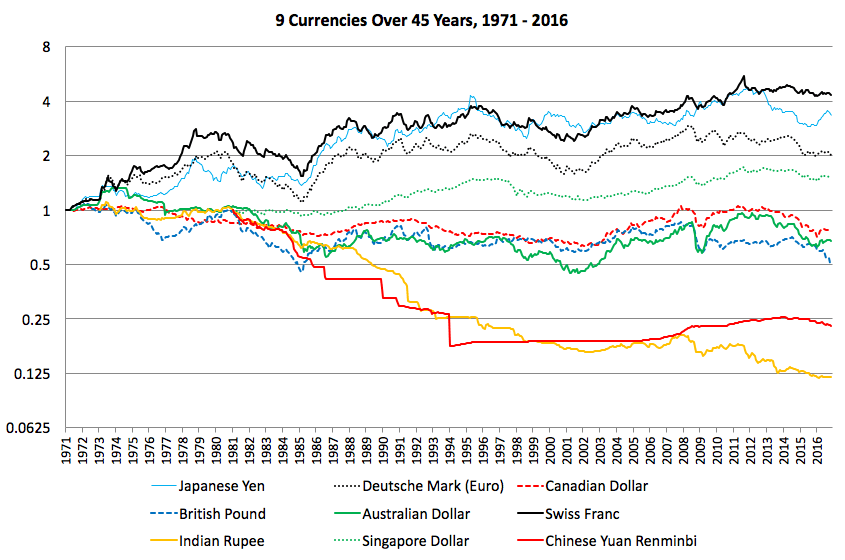

Currency markets, also called Money markets, are the one’s responsible for the transactions between nations, allowing the exchange of commerce to occur without major problems from currency (de)valuation and inflation. On the graphic below, we show the valuation over time of the world’s main currencies against the US Dollar. As we can see, the US Dollar lost value when compared to the Swiss Franc (CHF), the Japanese Yen (JPY), the Euro (EUR) and the Singaporean Dollar (SGD), while it has gained value when compared to the Canadian Dollar (CAD), Australian Dollar (AUD), the British Pound (GBP), the Chinese Renminbi (CNY) and the Indian Rupee (INR).

In conclusion

There are different commodities and each has a specific comparative advantage, such as hedging against future prices volatility, holding value in themselves or being used as a means of exchange. It’s up to the investor to understand them and create the adequate portfolio regarding the investment objetives.

Gold and silver are money, everything else is credit.

John Pierpont Morgan, founder of JP Morgan bank

Subscribe our media posts, follow our social media accounts and learn even more by clicking in the following icons.