Firstly, what are stocks and equity?

Stocks represent a portion of a listed company, meaning, a company that has it’s capital transactionable on a stock market or exchange. That portion represents an interest on that company, and may allow the investor, now stockholder, to certain rights such as voting on important decisions or the entitlement to dividends from the profits that the company presents. Also, it has obligations as to participate on calls to increase the capital and take the losses when the business was just not good in any period.

Equity is the residual interest on a company’s assets after all the liabilities are deducted, meaning that, in case the company was shut down, that would be the portion that would be available to distribute to the shareholders. Businesses finance their activities through equity and liabilities, equity being the shareholders’ capital, retained profits and reserves, and liabilities the debts towards suppliers, banks and others.

Overall, a stock represents a business, and a business is not the price of the stock but the economical activity behind it and the relations between people, between workers, suppliers, clients, authorities, and all the stakeholders. It’s important to know the business one is investing in, the financials but also the economical and management factors, the corporate governance and their impact on society.

So, what’s the perfomance?

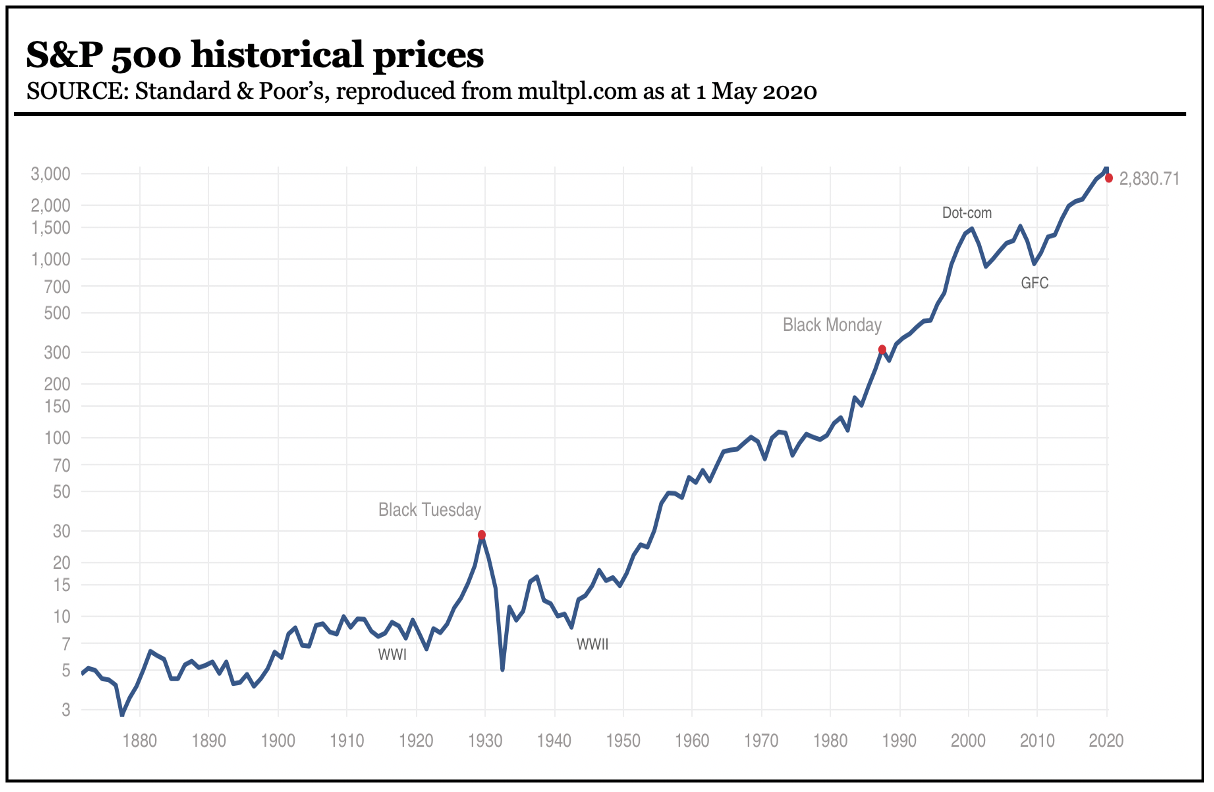

Overall, the stock market has returned very positive annualized gains, despite the many downfalls it had: the 1929 crash, the Black Monday, the Dotcom Crash from early on the millennium and the most recent crash from 2008-2009. Through time, it has maintained a consistent upward tendency and the top spot for investors to allocate their wealth, and will continue to be so in the foreseable future.

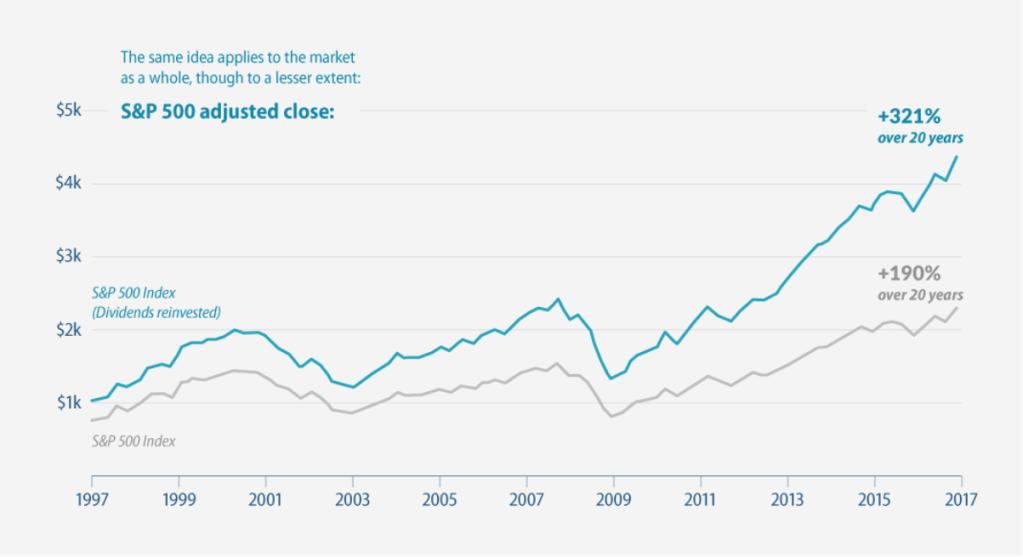

The returns from the stock market take two forms: dividends and capital gains (realized or not). Dividends are payments of parts of the profits that a company had in any given time period, to the owners of the companies, the stockholders. Capital gains refers to the variations in market price of the stocks held, be it realized, when the stock is sold or unrealized when it’s the difference between the current price and the acquisition price. This way, a stock can provide both cash-flow through the dividends and appreciation through the capital gains.

In conclusion

Stocks are a very risky security compared to other instruments such as bonds, treasury bills or liquid currency, but all of them have their own specific risks that should be accounted for. For it’s risk, stocks also have one of the major asset appreciation over the decades, and that’s is why they occupy a significant portion of of the world’s portfolios.

The real key to making money in stocks is not to get scared out of them.

Peter Lynch, author of One Up On Wall Street

Subscribe our media posts, follow our social media accounts and learn even more by clicking in the following icons.